From Financial Sovereignty to Personal Accountability

Decentralized systems have often been associated with the words freedom, independence, and sovereignty. These words do matter, but only equally half of everything, where the second half still has business with responsibility. When users acquire direct control over their assets, they also agree on the liabilities to make decisions. No one will question the execution of a transaction; nor will any intermediary constrain it on the basis of uncertainty or struggle to remedy some snagging issues when they happen. This has led naturally to positive encouragement for taking vigilant care and severely punishing negligence, a strong stand opposed to that taken in traditional financial systems.

Control Without Intermediaries

In traditional finance, responsibility is shared across multiple layers. Banks verify identities, payment processors flag suspicious activity, and customer support teams can reverse certain errors. Decentralized finance removes most of these safeguards by design. Users hold private keys, authorize transactions, and interact with smart contracts directly. This structure increases autonomy, but it also removes protective buffers.

Without intermediaries, mistakes are final. Sending funds to the wrong address, approving a malicious contract, or losing access credentials usually results in permanent loss. Responsibility here is not symbolic; it is operational. Users must understand what they are doing at each step, because the system will not stop them from making irreversible choices.

Understanding Ownership Beyond Balances

Ownership in decentralized finance is often described as “self-custody,” but the concept goes deeper than holding assets in a wallet. Ownership includes managing access, evaluating risks, and understanding how assets behave across different protocols. A balance displayed on a screen does not capture the full scope of responsibility involved.

For example, interacting with decentralized applications often requires granting permissions. These permissions can remain active long after a transaction is completed. Responsible participation means reviewing what access is being granted, why it is necessary, and how it can be revoked. Ownership is ongoing work, not a one-time setup.

The Absence of Automatic Protection

Many users approach decentralized finance with expectations shaped by traditional platforms. They assume errors can be appealed, accounts can be frozen, or support teams can intervene. In decentralized systems, these assumptions do not hold. The absence of automatic protection is not a flaw; it is a structural feature.

This reality places greater emphasis on preparation. Responsible users learn how transactions work, test new tools with small amounts, and avoid acting under pressure. The system will execute instructions exactly as given, regardless of intent. Understanding this helps users align their behavior with the system’s constraints rather than working against them.

Irreversible Transactions and Their Implications

Transaction-finalization forms one exemplary characteristic of blockchain digital finance. Surely, once a transaction has been completed, it becomes a permanent fixture in a shared ledger in which no tampering from intervention can be allowed. This risk is used to serve as an added layer of trust and transparency, despite the various possible further consequences deriving from any given action.

Finality as a Design Choice

Transaction finality is often framed as a technical feature, but it is also a philosophical one. By removing the ability to reverse transactions, decentralized systems reduce reliance on authority and judgment calls. The ledger reflects what happened, not what should have happened.

This design choice shifts responsibility entirely to the point of decision. Users must verify details before acting because there is no correction layer afterward. Addresses, amounts, and contract interactions must be checked carefully. The system prioritizes consistency over forgiveness, and responsible behavior adapts to that priority.

Common Errors and Their Consequences

Many irreversible losses stem from simple mistakes. Sending assets to an incompatible network, copying an address incorrectly, or misunderstanding a contract function can all lead to permanent loss. These errors are rarely the result of malice; they often arise from haste or unfamiliarity.

Responsibility here means slowing down and verifying assumptions. Experienced users often develop habits such as double-checking addresses, reading transaction prompts carefully, and using test environments when available. These habits reduce risk not by changing the system, but by adapting to its rules.

Emotional Decision-Making Under Irreversibility

Irreversible systems amplify the impact of emotional decisions. Acting out of fear, excitement, or urgency can have lasting consequences. Market volatility, social pressure, and misinformation can push users into making rushed choices that cannot be undone.

Responsible participation involves recognizing these emotional triggers and building strategies to counter them. This might include setting personal rules, such as waiting before executing large transactions or avoiding interactions during periods of high stress. Emotional discipline becomes a form of risk management in decentralized finance.

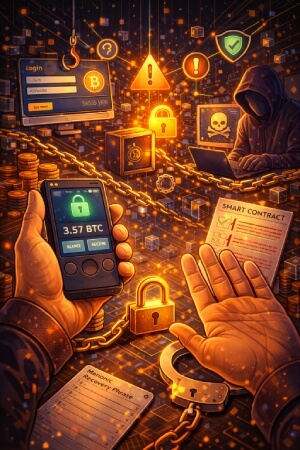

Security Awareness as a Core Responsibility

Security is not one controlled by a centralized authority within DeFi. It arises from a set of actions by users and developers. While systems must have provisions for security, individual actions play an even more influential role in the prevention of actual losses. Security is no longer just a side issue; it is unequivocally a responsibility.

Private Keys and Access Management

Private keys are the foundation of control in decentralized finance. Whoever holds the key controls the assets. Losing a key usually means losing access permanently, while exposing a key can lead to immediate theft. Managing keys responsibly is one of the most critical skills for participants.

This responsibility includes using secure storage methods, avoiding unnecessary exposure, and understanding the trade-offs of convenience tools. Hardware wallets, backups, and offline storage practices are not advanced options; they are basic safeguards. Treating private keys casually undermines the very sovereignty decentralized systems aim to provide.

Recognizing Social Engineering and Fraud

Not all risks in decentralized finance are technical. Social engineering attacks exploit human behavior rather than software vulnerabilities. Fake websites, impersonation, and misleading messages are common tactics used to trick users into signing malicious transactions or revealing sensitive information.

Responsible users learn to question unexpected prompts and unsolicited messages. They verify sources independently and avoid acting on urgency created by others. In an environment without centralized verification, skepticism becomes a protective skill rather than a sign of distrust.

Understanding Smart Contract Risk

Smart contracts automate financial logic, but they are not infallible. Bugs, flawed assumptions, and untested code can all introduce risk. While users cannot audit every contract they interact with, they can develop an awareness of how contract risk differs from traditional agreements.

Responsibility involves understanding that interacting with a contract means trusting its code. Users can reduce exposure by favoring well-reviewed protocols, limiting approvals, and monitoring ongoing permissions. Security awareness here is about proportional risk, not absolute certainty.

Informed Decision-Making in Open Financial Networks

Decentralized finance structure and workings are like one big library flair - probably a vast library with knowing that a vast chunk of data contain raw knowledge of varying quality. Even proposals from users were studied along with trade-related data and inputs from the community. In dealing with that sort of environment, evidence and patience become the tools that differentiate between judgment and indecision.

Responsible activity, a matter that goes beyond merely avoiding wrong moves, implies conscientious interference and real social grassroots involvement. These are the forces that breed decision-making that sustains the aspirations of individual agents and thereby maintains the networks' good health in a decentralized setting.

Separating Transparency from Understanding

Blockchains are transparent by design, but transparency does not guarantee comprehension. Data is publicly available, yet interpreting it correctly requires context. Transaction histories, token metrics, and governance proposals can be misread without sufficient understanding.

Responsible users recognize the limits of surface-level information. They take time to learn what data represents and how it should be interpreted. This reduces reliance on speculation and hearsay, which often drive poor decisions in open financial systems.

Risk Assessment Without Guarantees

Decentralized finance offers few guarantees. Returns are not insured, and protocols can change rapidly. Assessing risk therefore becomes a personal responsibility rather than an institutional service. Users must decide how much uncertainty they are willing to accept.

This process includes evaluating personal financial limits, understanding downside scenarios, and avoiding overexposure. Responsible decision-making prioritizes sustainability over short-term gains. It acknowledges that not every opportunity needs to be pursued.

The Role of Education and Continuous Learning

Decentralized finance evolves quickly. New tools, standards, and risks emerge regularly. Responsibility is not static; it requires ongoing learning. Users who treat their knowledge as complete are more likely to encounter avoidable problems.

Continuous learning does not mean chasing every trend. It means staying informed about core principles, updating security practices, and revisiting assumptions. In an open system, education functions as a form of self-defense and long-term participation.

Shared Responsibility and Network Health

While DeFi is highly decentralized with the individual being given a heavy weightage, it does not impede the common welfare. In these networks very much depend on participant behavior for stability-proof and fairness. This is where actions by the individual set the greatest precedent possible regarding the design of the overall system.

Aside from that, the entire network operates under each transaction but not upon the transaction amongst users. There are opportunities within each system, ethereum included, which have been somewhat utilized, whilst people neither know what they are or are not given credit for spreading some level of awareness. In cases such as harm prevention through more cooperative exploration or the just use of existents, the large role of community conduct, which can further enhance the growth owing to the network nurturing, shall be uplifted for the positive benefit of incentivizing the community further through encouragement.

Freedom That Demands Care

The real autonomy that decentralized finance offers carries a countervailing price, responsibility. When users experience irreversible transactions, direct control, and open participation, it is incumbent on them to act with awareness, patience, and sound decision-making.